- Start Doing Well

- Posts

- Why your paycheck might change soon

Why your paycheck might change soon

Megabill decoded, breaking up with BNPL, and a tracker that shows if you're really building wealth

It’s been a minute. So first, I’d like to thank you for sticking around.

If you’re feeling a little financially disoriented, you’re not alone.

The headlines are loud. Inflation is slightly cooling but prices still feel high, Congress just passed a $4T Megabill, and the internet can’t decide whether we’re in a spending era or a savings era. Somewhere between “treat yourself” and “cut everything” is the quiet truth: most of us are just trying to feel a little more in control.

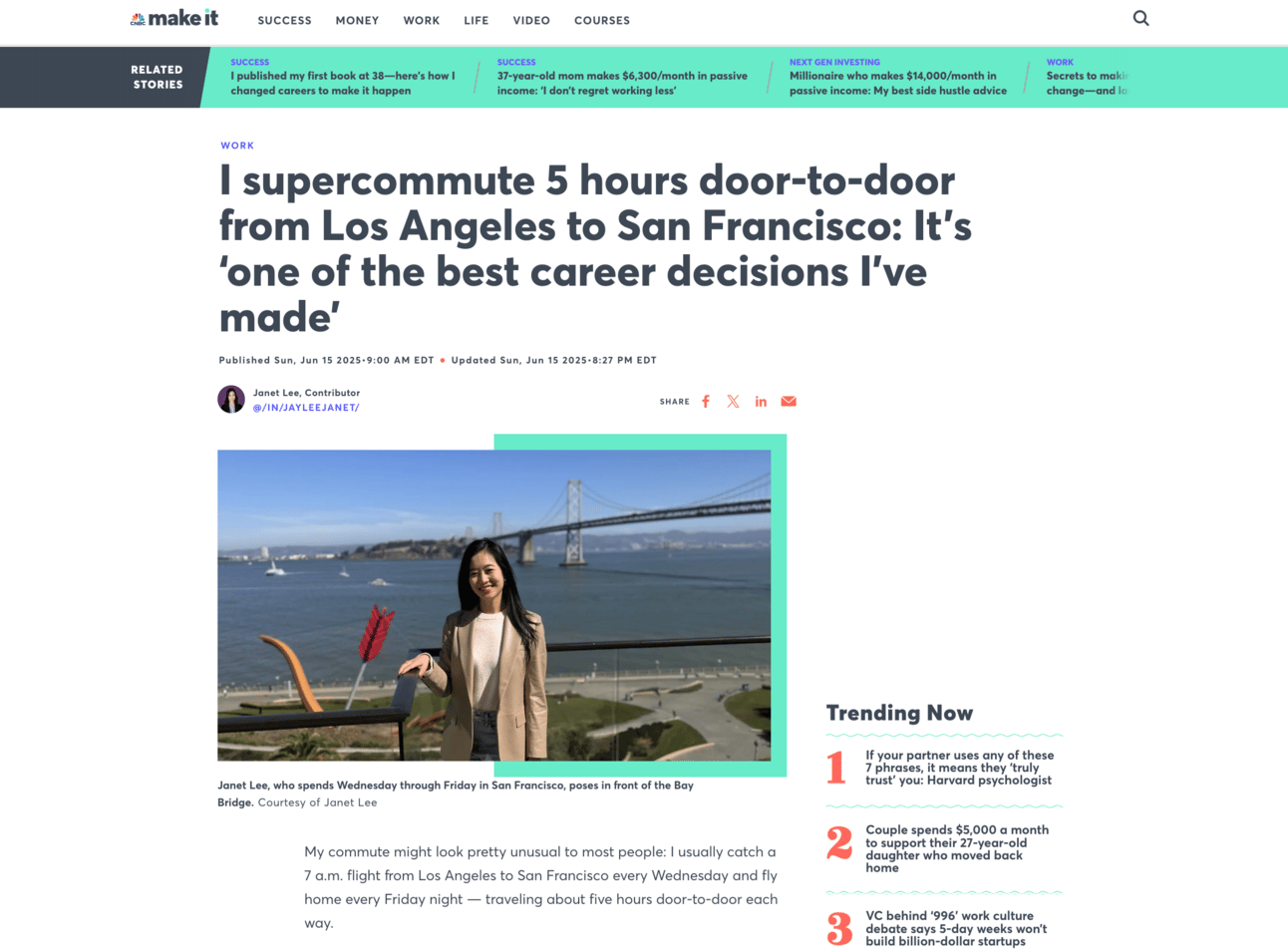

In the middle of all this chaos, a full-circle moment: CNBC published my super-commuter story (!!). If you’ve ever made a move that felt irrational on paper but undeniably right, I hope it resonates. Read it here →

That moment reminded me why Doing Well exists, and why this newsletter is back.

(Also: if you book a call and mention the CNBC article, you’ll get $25 off your plan!)

This week’s issue is about tuning out the noise, zooming in on what actually affects your money, and rebuilding that sense of clarity.

Here’s what’s inside:

Let’s get into it!

Hot on the Internet

The Megabill just passed the Senate 👉 What it actually means for your wallet

Congress just greenlit a sweeping $4T tax-and-spending bill… and it’s packed with changes that could shift your paycheck, savings habits, and even how you plan for next year.

It’s been marketed as a win for workers and retirees, but it’s also drawing criticism for potentially ballooning the national deficit. And while some benefits kick in quickly (like changes to paycheck deductions), others phase in or expire by 2028. The financial upside might be short-lived for many Americans.

Here’s what to know:

✅ You might see a bump in your take-home pay

The bill expands deductions for tips, overtime, and interest on U.S.-made car loans. This means more post-tax money, especially if you’re hourly or gig-based. But most of these perks expire in 2028, so it’s smarter to treat the extra as temporary.

💸 New breaks for older adults

Seniors get an extra $4K standard deduction, which could ease the burden for those on fixed incomes, or anyone financially supporting a parent.

📈 Higher debt, higher rates?

The bill adds an estimated $2.4–$3.3T to the deficit. That doesn’t hit today, but it could mean higher interest rates down the line. Credit card debt, student loans, and adjustable-rate mortgages might all get more expensive.

🎯 What to do:

Run a paycheck preview using your tax software to estimate your updated take-home.

Don’t count on temporary savings to last. Channel extra cash into your emergency fund or high-interest debt.

Lock in fixed rates where possible if you’ve been delaying refinancing or borrowing.

Reality Check

BNPL isn’t always your best friend. Here’s how it affects your credit score.

It feels easy, but Buy Now, Pay Later services like Klarna and Afterpay are now being factored into new credit score models.

FICO and VantageScore are both rolling out updates that treat BNPL like traditional credit. So if you miss a payment, it will follow you.

Here’s how it can affect your score:

📉 Miss a BNPL payment: That can ding your score just like a late credit card bill.

📈 Pay on time: It might help boost your credit… but only if you’re using it regularly and responsibly.

🧠 Tip: BNPL is best for planned purchases you could afford to pay in full and not for filling budget gaps.

So while it’s tempting to split up that $180 flight or Target run, just know: it’s not free money, and the credit bureaus are watching now.

Cheat Sheet Corner

Summer = time to explore new hobbies

If you have a little extra free time, it might be worth turning it into joy, growth, and maybe even income.

Here are the 5 core hobby categories that can enrich your life (and how to pick one for each this summer):

💰 To make money (Freelance, sell art, flip thrift finds)

💪 To keep you fit (Hiking, dancing, yoga)

🎨 To express creativity (Paint, cook, write, film)

📚 To grow your knowledge (Read, learn a skill, listen to podcasts)

🧘 To evolve your mindset (Journal, meditate, reflect)

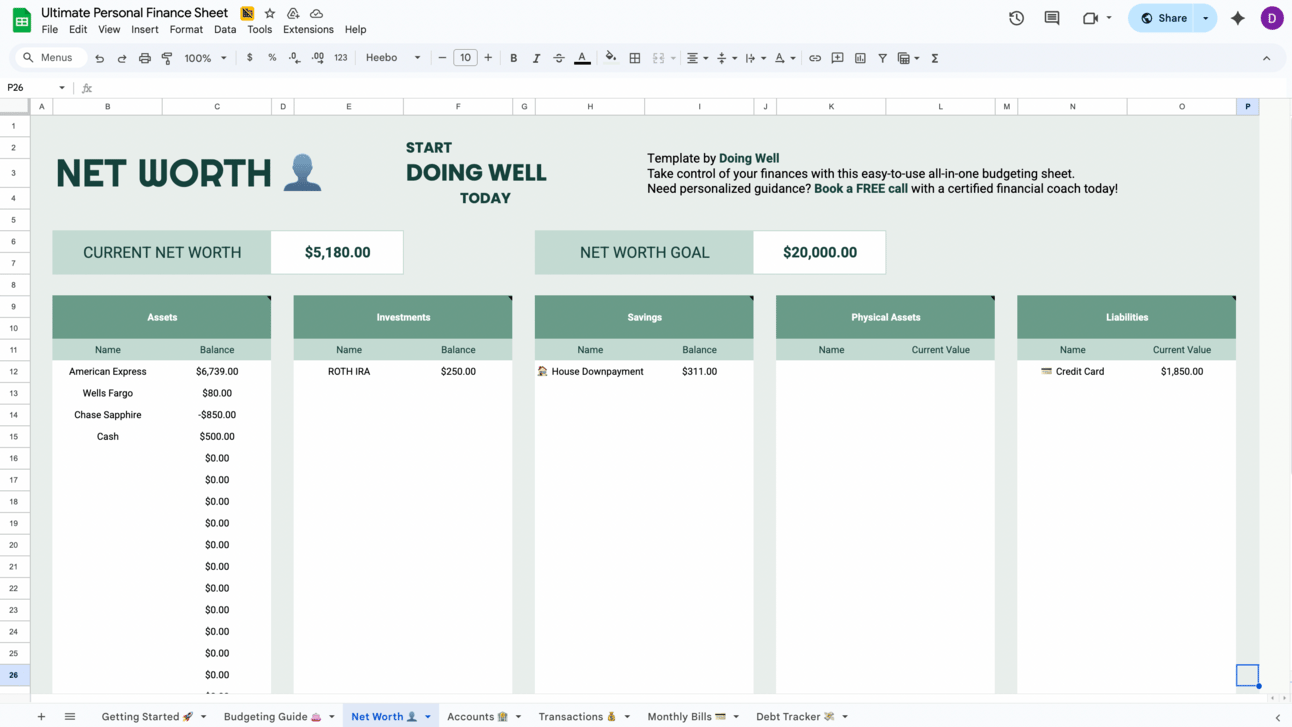

Getting serious with tracking your financial life? You may be missing out on this

Budgeting shows where your money goes, but net worth shows what you're building. It's the full picture: assets (what you own) minus liabilities (what you owe).

Watching it grow over time is one of the clearest ways to see progress, even if your income doesn’t change.

If you haven’t checked yours lately (or ever) now’s the time. Use this free tracker to plug in your numbers and keep tabs each quarter.

Worth the Click This Week

💵 New term alert (Revenge Saving): After months of swiping and splurging, people are flipping the switch… hoarding cash not out of discipline, but spite. Weirdly relatable. Read more »

😩 Even six figures doesn’t go as far anymore: New data shows that many high earners still feel financially stretched. Between housing, childcare, and lifestyle creep, it’s a reminder that income alone doesn’t guarantee peace of mind. See the breakdown »

📍Job market winners of 2025: Bend, Oregon is having a moment. This roundup shows the best cities for jobs right now—and where people are quietly thriving. Check the list »

🔥 49% savings rate on a freelance income?: Lesley’s story is proof that even inconsistent paychecks can turn into major progress with the right system. Steal her approach »