- Start Doing Well

- Posts

- Your loan balance might go up next month

Your loan balance might go up next month

Student loan updates, peace-of-mind savings, and burnout buffers that help you reset

We’re deep into summer, which usually means slowing down, taking a breath, maybe even catching up with yourself. But even in the quiet, money things keep moving. Loan reminders roll in, small expenses pile up, and that nagging “am I doing enough?” question can creep back in.

Quick reminder that you don’t have to do everything perfectly. Sometimes, checking in on just one part of your finances is more than enough. Whether it’s understanding where your money’s going, adjusting your savings goal, or just carving out time to rest, small moves still count.

Here’s what’s inside:

Let’s get into it!

Hot on the Internet

Heads up: Your federal loan balance might grow again

The federal SAVE plan just hit a legal roadblock. A recent court ruling is forcing the Department of Education to strip away part of the plan.

In a nutshell: interest will resume for SAVE borrowers starting August 1.

This doesn’t mean the entire plan is gone, but that zero-interest benefit is out the door for now. The Department of Education will start reaching out to borrowers around July 10 with more info on how to switch to a legal repayment plan if needed.

If you’re currently on SAVE, here’s how to prepare:

✅ Log into StudentAid.gov and check your repayment plan

✅ If your income dropped recently, re-certify now to lock in lower payments

✅ Use the Loan Simulator to see if a different plan saves you money

✅ Expect higher balances once interest resumes, and prep your budget accordingly

✅ Watch your inbox for an official update from the DOE

Reality Check

Forget Instagram money goals. A new study shows you don’t need six figures in the bank to feel financially secure.

Just $2,000 in savings can already make a huge difference.

Researchers found that people with at least that amount reported better day-to-day well-being, more confidence in handling emergencies, and less financial stress overall.

The study also looked at how savings impact long-term financial health. And while more savings does help, the biggest leap in stability happens when you move from $0 to just a few thousand dollars.

It’s a reminder that small wins add up and building a financial buffer (even a modest one) is a major step forward.

🤔 What savings number feels like “enough” to you (at least for now)?

Cheat Sheet Corner

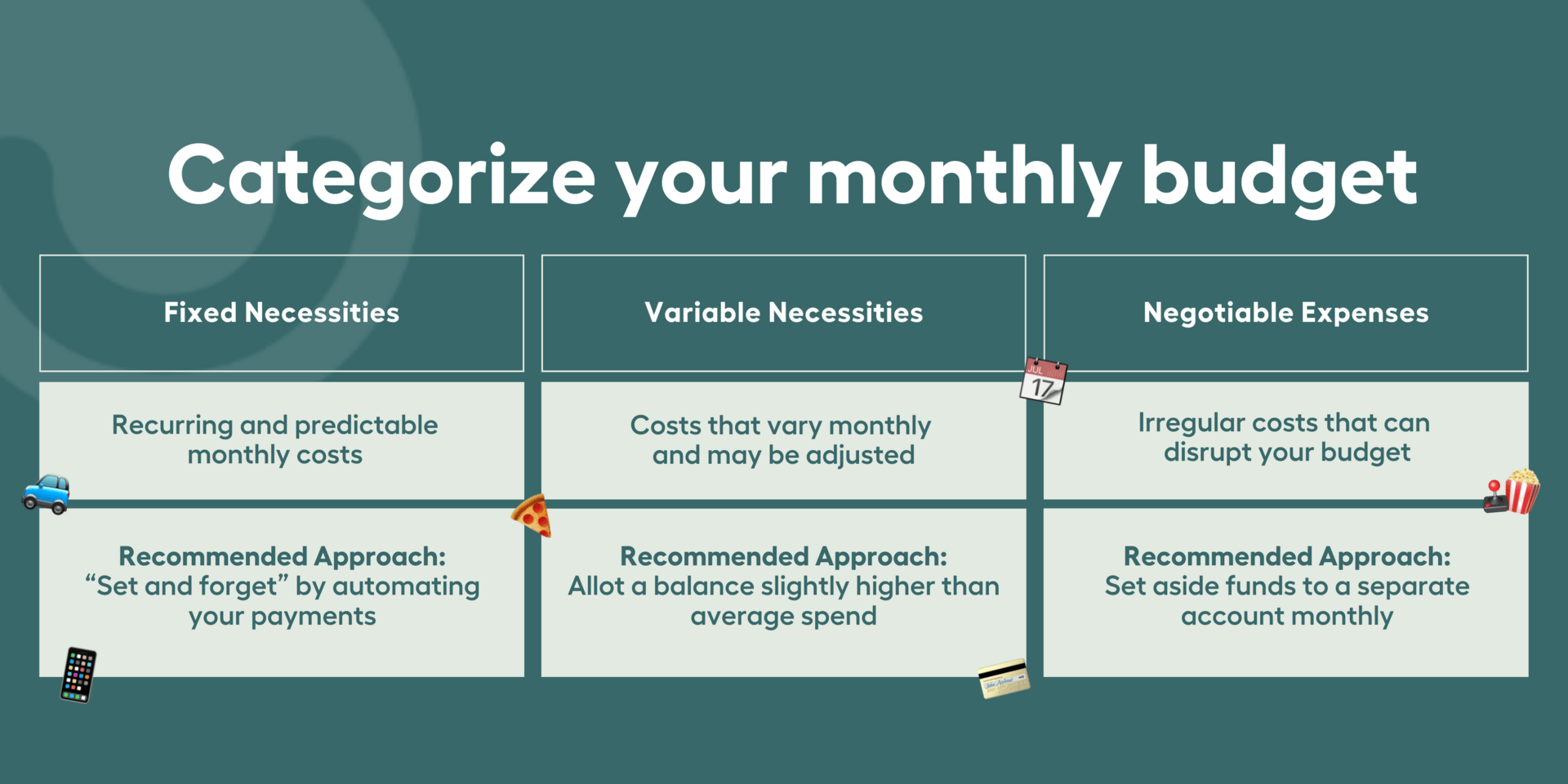

How to split your budget without overthinking it

Instead of tracking a million line items, try this 3-bucket system. It keeps things simple, flexible, and actually doable.

Just getting these buckets in place can make your money feel a lot less chaotic. 👉 Use this full guide to start organizing your spending.

How much are people actually saving for retirement?

The average 401(k) savings rate (including employer matches )is now 13.9%, according to Vanguard’s latest data. That’s up slightly from last year, but here's the real story:

Most people aren’t maxing out

The median employee contribution is closer to 7%

And fewer than 15% of workers hit the federal max

So if you’re not hitting 20% or maxing your 401(k), don’t stress. You’re not behind.

But if you do have room to increase your contribution by 1–2%, it can make a huge difference over time (especially if your employer matches). 👉 Read the full breakdown here

Worth the Click This Week

📅 Non-negotiable days are the new calendar hack: Whether it’s a rest day or a catch-up day, protecting your time isn’t selfish. It’s necessary. Mark your non-negotiable days »

😮💨 The Burnout Buffer: This is why you’re exhausted even when you’re technically “off.” A reminder to rest before you hit the wall. Gentle nudge to slow down »

🌍 If you're dreaming of a Euro summer: Getting there might be cheaper this year, but once you land, everything from gelato to hotels is pricier than expected. Here’s what to budget for »

💸 The price jump is real: Use this interactive tool to see how much more you'd pay for the same thing today. Just plug in the year and cost, and watch inflation do its thing. Try the calculator »

📜 Big moves ahead for elder care: A new federal bill could change how long-term care gets funded. Even if you’re not thinking about it yet, your parents (or future self) might be. Here’s what to know »